Top Business Valuation Methods in 2025 | Expert Insights

- Assetica

- Apr 19, 2025

- 19 min read

Unlocking Business Value: A Guide to Valuation Methods

Understanding your business's worth is crucial for financial planning, strategic decisions, and transactions like selling or fundraising. This guide explores seven key business valuation methods, outlining their advantages, disadvantages, and practical uses. Learn about Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), Precedent Transaction Analysis, Asset-Based Valuation, and various Earnings Multiples (P/E ratio, EBITDA, and Capitalization of Earnings). By understanding these methods, you can determine the optimal approach for accurately valuing your business and making informed decisions.

1. Discounted Cash Flow (DCF) Method

The Discounted Cash Flow (DCF) method is a cornerstone of business valuation, used to estimate the value of a business by projecting its future cash flows and discounting them back to their present value. This approach hinges on the principle of the time value of money – the idea that money available today is worth more than the same amount in the future due to its potential earning capacity. DCF analysis focuses on the business's ability to generate cash as the primary driver of its current worth, making it a powerful tool for investors and stakeholders. This method deserves its place in any business valuation discussion due to its theoretical rigor and focus on future earning potential.

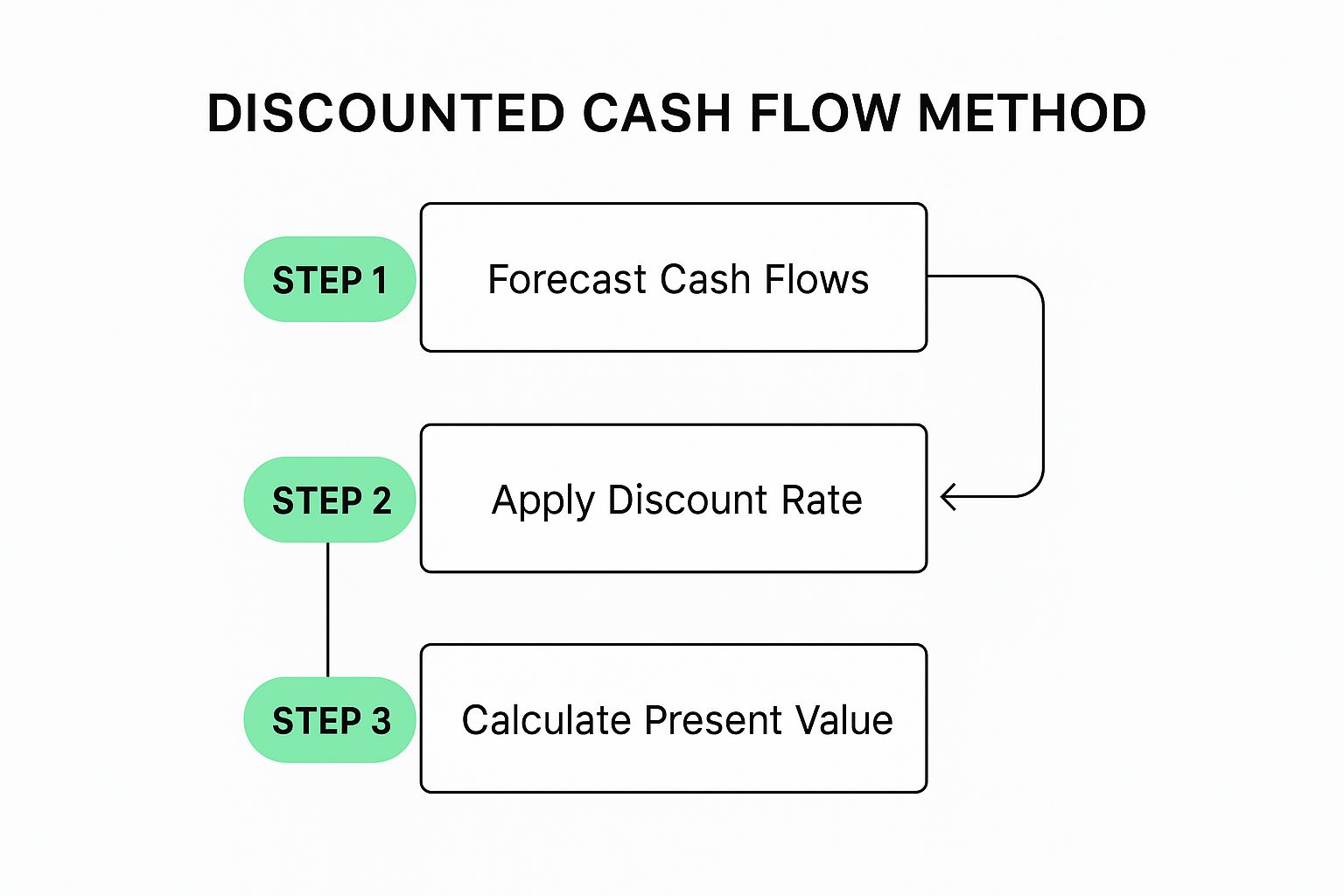

The infographic illustrates the process of conducting a DCF analysis. It begins with projecting free cash flows, then calculates the terminal value, and finally discounts both back to present value to arrive at the total enterprise value. The visual representation clarifies the importance of each step in arriving at a final valuation.

The DCF method is characterized by several key features: projecting cash flows for a typical forecast period of 5-10 years, calculating a terminal value to account for cash flows beyond this period, applying a discount rate (often the Weighted Average Cost of Capital - WACC), and inherently considering the time value of money and the risk associated with future cash flows.

The DCF method is particularly well-suited for established businesses with predictable cash flows and a clear growth trajectory. Its adaptability allows for various business types and growth stages, incorporating diverse scenarios and risk profiles. The method also allows analysts to assess the long-term potential of a business, going beyond simple accounting metrics. Think of established companies like Coca-Cola, or even a mature tech company; DCF helps understand their intrinsic value based on projected future earnings. Investment banks frequently utilize DCF in M&A valuations, as exemplified by Morgan Stanley's valuation of LinkedIn before its acquisition by Microsoft. Similarly, private equity firms such as Blackstone rely on DCF models for leveraged buyout targets. Even Warren Buffett, a staunch advocate of value investing, has famously employed DCF to evaluate companies like Coca-Cola before Berkshire Hathaway's investment.

However, the DCF method also has its drawbacks. It’s highly sensitive to the assumptions used, especially the discount rate and growth rate. The required detailed forecasting becomes less reliable further into the future, and the complex calculations often demand financial expertise. It can be challenging to apply to startups or businesses with unpredictable cash flows and may undervalue assets not generating immediate cash flow.

For businesses and investors in the AE region considering using DCF for valuation, these tips are crucial: base growth projections on historical performance and industry trends, conduct sensitivity analysis by adjusting key assumptions, compare DCF results with other valuation methods, and consider multiple scenarios (best case, worst case, most likely). Be particularly cautious with terminal value calculations, as they frequently constitute a significant portion of the total value. Learn more about Discounted Cash Flow (DCF) Method By carefully considering the pros and cons and implementing these tips, businesses and investors can leverage the power of the DCF method for informed decision-making.

2. Comparable Company Analysis (CCA)

Comparable Company Analysis (CCA), also known as 'trading multiples' or 'public market multiples,' is a business valuation method that benchmarks a company's value against similar publicly traded companies. It operates on the principle that companies with comparable characteristics, such as industry, size, growth rate, and risk profile, should have similar valuation multiples. Analysts identify a group of peer companies, calculate relevant multiples (like Enterprise Value (EV) to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) or Price-to-Earnings (P/E) ratios), and apply these multiples to the target company's financial metrics to estimate its value. This method is a cornerstone of business valuation, especially useful for businesses considering mergers and acquisitions, initial public offerings (IPOs), or raising capital.

CCA deserves a prominent place in any discussion of business valuation methods due to its market-driven approach and relative simplicity. Key features include the use of market-based valuation multiples derived from publicly traded peer companies. Common multiples include EV/EBITDA, P/E, Price-to-Sales (P/S), and Price-to-Book (P/B) ratios. The process requires careful identification of truly comparable companies, considering factors like size, growth prospects, risk profile, and business model. Because private companies often lack the liquidity and market exposure of public companies, a discount is often applied to their valuations derived from CCA. Importantly, CCA reflects current market sentiment and prevailing economic conditions, providing a real-time snapshot of how the market values similar businesses.

Examples of Successful Implementation:

Goldman Sachs utilized CCA as part of their valuation process for Facebook's IPO in 2012.

Spotify's 2018 direct listing valuation relied significantly on comparable analysis with other streaming music competitors.

Raymond James analysts frequently incorporate peer multiples in their equity research reports for retail stocks.

Actionable Tips for Using CCA:

Select appropriate peers: Focus on companies with similar growth rates, profit margins, and business models to ensure a relevant comparison.

Use multiple valuation metrics: Employing a variety of multiples like EV/EBITDA, P/E, P/S, and P/B provides a more comprehensive and robust valuation range.

Adjust for outliers: Identify and adjust for any outliers within the comparable set that may skew the valuation results.

Apply discounts: Incorporate discounts for size, liquidity, or diversification differences between the target company and its public peers.

Consider forward-looking multiples: Utilize forward-looking multiples, in addition to trailing multiples, to capture anticipated future growth potential.

When and Why to Use CCA:

CCA is particularly valuable in the following scenarios:

Mergers and Acquisitions: Provides a market-based benchmark for valuing acquisition targets.

Initial Public Offerings (IPOs): Helps determine an appropriate IPO pricing range.

Fundraising: Offers a credible valuation to support fundraising efforts.

Strategic Planning: Provides insights into a company's relative market position and potential value drivers.

Pros and Cons of CCA:

Pros:

Based on actual market transactions and valuations.

Relatively simple to calculate and understand.

Incorporates market sentiment and investor perspectives.

Applicable across various industries using appropriate multiples.

Provides a range of potential values, offering a more nuanced perspective than a single-point estimate.

Cons:

Finding truly comparable public companies can be challenging, particularly for businesses with unique characteristics.

Valuations can be influenced by temporary market mispricing or bubbles.

Doesn't directly account for company-specific future growth potential or internal strategic initiatives.

Fails to consider differences in accounting practices between companies, potentially leading to inconsistencies.

Market multiples fluctuate with market conditions, resulting in valuation volatility.

Learn more about Comparable Company Analysis (CCA)

This method is valuable for businesses, startups, buyers, sellers, and those involved in mergers and acquisitions in the AE region, providing a crucial framework for understanding market-driven valuations within the context of current economic conditions.

3. Precedent Transaction Analysis

Precedent Transaction Analysis (PTA) is a business valuation method that determines a company's worth based on the prices paid for similar businesses in previous mergers and acquisitions (M&A). This approach examines historical transactions, focusing on companies in the same industry with comparable size, financial performance, and growth prospects. By analyzing these deals, valuators can derive transaction multiples, such as Enterprise Value (EV) to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), EV to Revenue, or Price to Earnings (P/E), and apply them to the target company's financials to arrive at a valuation. This method is particularly relevant when considering an acquisition as it inherently captures the "control premium" – the additional amount a buyer is willing to pay for the advantages of owning and controlling a business. This premium is often not reflected in other business valuation methods. PTA is a crucial tool among the array of business valuation methods available to stakeholders.

PTA stands out among business valuation methods because it's grounded in actual market transactions, not just theoretical calculations. It analyzes real deals where buyers and sellers negotiated and agreed upon a price, offering valuable insights into market sentiment and the perceived value of similar businesses. Key features of PTA include analyzing M&A transactions within the same industry, incorporating the control premiums paid by acquirers, employing multiples derived from completed transactions, and considering the strategic value and synergies reflected in those prices. Because of the control premium, PTA typically results in higher valuations than methods like Comparable Company Analysis. For example, if a company is considering acquiring a competitor, PTA provides a more accurate picture of the expected acquisition cost by reflecting the premiums paid in comparable deals.

Examples of Successful Implementation:

JPMorgan Chase's valuation of Bear Stearns during the 2008 financial crisis relied partly on precedent transactions, helping to determine a fair price amidst market turmoil.

Disney's acquisition of 21st Century Fox utilized PTA by examining previous media consolidation deals to assess the appropriate valuation range.

Pharmaceutical company valuations frequently depend on precedent transactions due to the prevalence of industry-specific multiples and the importance of acquired drug pipelines.

Pros:

Based on real-world transaction prices, offering more empirical grounding than some other business valuation methods.

Explicitly includes control premiums and synergy valuations, leading to more realistic valuations in M&A scenarios.

Highly relevant for M&A situations, providing a direct market benchmark.

Captures strategic value beyond standalone financial performance.

Reflects actual buyer behavior and willingness to pay.

Cons:

Finding truly comparable transactions can be challenging, particularly for private companies with limited publicly available data.

Historical transactions may not accurately reflect current market conditions, especially in rapidly evolving industries.

Publicly available details on past transactions might be insufficient to fully understand the context and specific nuances.

Older transactions may be less relevant due to changes in industry dynamics, technology, or regulation.

Transactions often include company-specific synergies not applicable to all buyers, requiring careful consideration and adjustments.

Tips for Effective Use:

Prioritize recent transactions (within the past 2-3 years) to capture current market dynamics.

Adjust for differences in market conditions between transaction dates and the present day.

Carefully consider the strategic rationale behind each comparable transaction to ensure true comparability.

Employ multiple transaction multiples (EV/EBITDA, EV/Revenue, P/E) for a more robust and comprehensive analysis.

Thoroughly research the terms of comparable deals to understand any unique factors or circumstances that influenced the final price.

Popularized By:

Investment banking advisory teams, merger arbitrage hedge funds (like Paulson & Co.), and corporate development departments of major corporations frequently use PTA.

This method is particularly valuable for businesses in the AE region experiencing increasing M&A activity. By understanding PTA, business owners, buyers, and investors can make more informed decisions in acquisition scenarios, ensuring fair valuations that reflect current market realities.

4. Asset-Based Valuation

Asset-based valuation is a business valuation method that focuses on a company's net asset value (NAV), calculated as the difference between the fair market value of its assets and its liabilities. Unlike methods that prioritize earnings, this approach takes a balance sheet perspective, emphasizing what a business owns rather than what it earns. This makes it particularly relevant for asset-intensive businesses, companies facing liquidation, or those holding significant tangible assets potentially undervalued on their financial statements. This method secures its place among business valuation methods due to its straightforward nature and its focus on tangible worth, making it a crucial tool in certain scenarios.

Asset-based valuation involves meticulously valuing individual assets and liabilities at their fair market value, which often necessitates adjustments to the book values listed on the balance sheet to reflect current market conditions. This can involve professional appraisals of major assets such as real estate, equipment, or specialized inventory. Both tangible assets (like property, plant, and equipment) and intangible assets (like patents, trademarks, and customer relationships) are considered. The resulting valuation can be presented as either a going concern value (assuming continued operation) or a liquidation value (assuming a forced sale of assets). Learn more about Asset-Based Valuation for a deeper understanding of this approach.

For example, BlackRock, when valuing commercial real estate portfolios, often initiates the process with asset-based approaches. Similarly, Berkshire Hathaway's acquisition of BNSF Railway factored in the replacement value of the company's extensive physical assets. In the realm of distressed businesses, bankruptcy courts frequently utilize asset-based methods to determine liquidation values during Chapter 7 proceedings.

Pros:

Straightforward and easy to understand: The concept of net asset value is relatively simple to grasp.

Useful for asset-heavy businesses: Particularly relevant for industries like real estate, manufacturing, and natural resources.

Provides a floor value: Offers a minimum value, especially crucial in distressed situations.

Less reliant on projections: Minimizes dependence on future financial projections and growth assumptions.

Helpful with limited earnings history: Useful when a company's earnings are unpredictable or its operational history is short.

Cons:

May undervalue intangible assets: Can struggle to accurately capture the value of intellectual property, brand recognition, or customer loyalty.

Ignores future earnings potential: Doesn't account for growth prospects, making it less suitable for high-growth companies.

Book value discrepancies: Book values often deviate significantly from market values, requiring adjustments and appraisals.

Costly and time-consuming: Extensive asset appraisals can be expensive and take considerable time.

Not ideal for service businesses: Limited applicability for companies with minimal physical assets.

Tips for Effective Asset-Based Valuation:

Adjust book values: Ensure book values reflect current market realities.

Hire specialized appraisers: Engage professionals for valuing complex assets like real estate or specialized equipment.

Include off-balance sheet items: Consider assets and liabilities not recorded on the balance sheet, such as operating leases or contingent liabilities.

Calculate both liquidation and fair market value: Assess value under both forced and orderly sale scenarios.

Value intangible assets: Don't overlook the contribution of intangible assets like patents, trademarks, and customer lists.

Asset-based valuation, popularized by value investing pioneers like Benjamin Graham and employed by distressed asset investors such as Sam Zell, and frequently used by Real Estate Investment Trusts (REITs), remains a cornerstone among business valuation methods, particularly for businesses in the AE region where real estate and tangible assets often play a significant role. It provides a concrete and practical approach to understanding a company's fundamental worth based on its underlying assets.

5. Earnings Multiple Method (P/E Ratio)

The Earnings Multiple Method, also known as the P/E ratio method, is a popular business valuation method used to estimate the value of a company. It's particularly prevalent among business valuation methods because of its simplicity and accessibility. This approach calculates a company's worth by multiplying its earnings by a market-determined multiple, reflecting how much investors are willing to pay for each unit of earnings. This makes it a crucial tool for anyone involved in buying, selling, or investing in businesses, including startups, established companies, and those involved in mergers and acquisitions.

How It Works:

This method relies on the price-to-earnings (P/E) ratio, which is calculated by dividing the market price per share by the earnings per share (EPS). In the context of business valuation, we reverse this process. We multiply the company's earnings (typically net income, but sometimes EBIT or EBITDA) by an appropriate P/E ratio to arrive at a valuation. This P/E ratio is typically derived from industry averages, comparable companies (often publicly traded competitors), or a combination of both.

Features and Benefits:

Uses a multiplier: This method simplifies the valuation process by applying a single multiplier to current or projected earnings.

P/E ratios from benchmarks: Ratios are typically derived from industry standards or comparable companies, providing a market-based valuation.

Flexibility with earnings: The method can utilize trailing earnings (historical) or forward earnings (projected), allowing for different valuation perspectives.

Simple calculation: The core calculation is straightforward: Value = Earnings × P/E Ratio.

Variations: The method can be adapted by using EBIT or EBITDA instead of net income, providing flexibility in addressing different financial situations.

Direct link to profitability: It explicitly connects a company's value to its profitability, a key driver of investor interest.

Pros:

Simple and Communicative: Easy to calculate and explain to stakeholders.

Widely Understood: Accepted and used across various industries.

Quick Comparison: Facilitates rapid comparison between companies within a sector.

Profitability Focus: Directly links valuation to earnings, a key performance indicator.

Useful with Data: Effective when reliable comparable P/E data is available.

Cons:

Oversimplification: Can overlook complex business dynamics and intangible assets.

Accounting Sensitivity: Susceptible to manipulation through accounting practices and one-time events.

Unsuitable for Unstable Earnings: Not applicable to companies with negative or highly fluctuating earnings.

Ignores Balance Sheet: Doesn't consider the strength of the balance sheet or cash flow generation.

Market Dependent: P/E ratios are influenced by market sentiment and economic cycles, leading to potential volatility.

Examples:

Small Businesses: Business brokers frequently use P/E multiples of 3-5x earnings for valuing local service businesses.

High-Growth Startups: Technology startups, with high growth expectations, might employ forward P/E ratios of 20-30x or even higher.

Value Investing: Warren Buffett's investment philosophy has often involved targeting companies trading at low P/E ratios relative to their intrinsic value.

Tips for Implementation:

Adjust Earnings: Normalize earnings by removing one-time events and owner-specific expenses to get a clearer picture of true profitability.

Industry Benchmarks: Utilize industry-specific P/E benchmarks instead of broad market averages for more accurate comparisons.

Valuation Range: Consider a range of P/E ratios to establish a valuation range, acknowledging the inherent uncertainty in the process.

Private Company Discount: Apply a discount to public company P/E ratios when valuing private companies due to their lower liquidity.

Growth Considerations: Factor in projected growth rates when determining appropriate P/E multiples, as higher growth typically warrants a higher multiple.

Why This Method Deserves Its Place:

The Earnings Multiple Method earns its place as a cornerstone business valuation method due to its practicality and widespread acceptance. While not a standalone solution, it provides a quick and accessible starting point for understanding a company's worth, particularly when benchmarking against industry peers. When used in conjunction with other valuation methods, it contributes to a more comprehensive and informed valuation. This is essential for making sound investment decisions, negotiating mergers and acquisitions, and understanding the overall financial health of a business in the AE region and beyond.

6. EBITDA Multiple Method

The EBITDA Multiple Method is a widely used business valuation method, especially relevant in the AE region and globally, for mergers and acquisitions (M&A), private equity deals, and general business valuations. It deserves a place on this list of business valuation methods due to its prevalence, relative simplicity, and focus on operational performance. This method calculates the value of a business by multiplying its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) by a predetermined multiple. This approach offers a snapshot of a company's profitability from core operations, neutralizing the effects of different capital structures, tax regimes, and depreciation policies – crucial factors to consider when comparing businesses across the AE region, given the diverse economic landscapes.

How it Works:

The EBITDA Multiple Method uses the Enterprise Value (EV) to EBITDA ratio. Enterprise Value represents the total value of a business, including debt, and is calculated as Market Capitalization + Debt - Cash. By dividing the EV by EBITDA, you arrive at the EBITDA multiple. This multiple represents how many times EBITDA the market is willing to pay for a company.

Features and Benefits:

Focus on Operational Performance: By excluding interest, taxes, depreciation, and amortization, this method isolates the earnings generated from core business operations.

Comparability: This method allows for apples-to-apples comparisons between companies with different capital structures, tax situations, and depreciation methods.

Simplicity: The calculation is straightforward and easy to understand.

Widely Accepted: The EBITDA multiple is a common metric used in M&A transactions and private equity valuations.

Proxy for Cash Flow: EBITDA often serves as a good proxy for operating cash flow, providing insight into a company's ability to generate cash.

Pros:

Facilitates comparison between companies with varying capital structures.

Emphasizes operational performance rather than accounting results.

Eliminates distortions caused by different depreciation methodologies.

Widely recognized and utilized in M&A and private equity deals.

Serves as a reliable indicator of operating cash flow for many businesses.

Cons:

Neglects capital expenditure requirements, which can differ significantly across industries.

Doesn't factor in working capital needs.

May overvalue capital-intensive businesses needing continuous reinvestment.

Not suitable for companies with significant intangible assets or substantial R&D expenditures.

Can be irrelevant for early-stage companies with negative EBITDA.

Examples of Successful Implementation:

Private equity giants like KKR frequently utilize EBITDA multiples as a primary valuation metric in their leveraged buyouts.

The acquisition of Kraft by Heinz, orchestrated by 3G Capital and Berkshire Hathaway, was reportedly based on an EBITDA multiple of approximately 16x.

Restaurant acquisitions typically trade within a range of 5-8x EBITDA, while software companies often command multiples of 10-15x or higher. These examples underscore the diverse application of this method across various sectors.

Actionable Tips:

Normalize EBITDA: Adjust EBITDA for any one-time expenses or unusual events to get a clearer picture of recurring profitability.

Use a 3-Year Average: For cyclical businesses, consider using a 3-year average EBITDA to smooth out fluctuations.

Adjust for Lease Accounting: Ensure consistency in lease accounting, particularly considering the impact of IFRS 16/ASC 842.

Industry-Specific Comparisons: Compare multiples against industry-specific benchmarks rather than general market averages.

Project Growth Rates: Incorporate projected EBITDA growth rates when determining appropriate multiples.

When and Why to Use This Approach:

The EBITDA Multiple Method is most effective when valuing mature, profitable businesses with predictable cash flows, especially within specific sectors like restaurants. It's less suitable for companies with substantial intangible assets, high R&D expenses, or negative EBITDA. For businesses in the AE region experiencing rapid growth or significant volatility, alternative valuation methods may provide a more accurate assessment.

Learn more about EBITDA Multiple Method

This method provides a valuable tool for business owners, startups, buyers, sellers, and those involved in mergers and acquisitions to quickly assess a company's worth based on its operational performance. However, remember to consider its limitations and use it in conjunction with other valuation methods for a more comprehensive evaluation.

7. Capitalization of Earnings Method

The Capitalization of Earnings Method is a valuable tool in the arsenal of business valuation methods, particularly useful for established businesses with predictable earnings. It offers a streamlined approach compared to more complex methods like the Discounted Cash Flow (DCF) analysis, making it a popular choice for business owners, brokers, and buyers in the AE region and beyond. This method deserves its place on this list due to its simplicity, focus on sustainable earnings, and applicability to a wide range of stable businesses. It provides a solid foundation for valuation when future earnings can be reasonably projected.

This method works by dividing the company's normalized future earnings by a capitalization rate (cap rate). The cap rate itself is derived by subtracting the expected long-term growth rate from the discount rate. Essentially, this calculation represents the rate of return an investor would expect on their investment in the business, considering both the risk and the potential for future earnings growth. This method assumes a relatively stable earnings pattern and moderate, consistent growth in perpetuity. It simplifies the valuation process by using a single, representative earnings figure, rather than detailed year-by-year projections required by a full DCF analysis. The focus is firmly on the sustainable, maintainable earnings capacity of the business, filtering out short-term fluctuations and one-time events.

Features of the Capitalization of Earnings Method:

Divides normalized earnings by a capitalization rate (cap rate).

Cap rate = Discount rate - Expected growth rate.

Assumes relatively stable earnings and growth.

Typically uses a single earnings value.

Focuses on sustainable, maintainable earnings.

Pros:

Simpler than DCF: Offers a more straightforward analysis than a full DCF, while still incorporating future earnings potential.

Suitable for Stable Businesses: Works effectively for mature businesses with predictable cash flows, such as professional service firms, established retail operations, or stable manufacturing companies.

Easy to Understand: Relatively easy to explain and comprehend, facilitating clear communication between business owners, buyers, and advisors.

Focus on Sustainable Earnings: Emphasizes sustainable earning capacity rather than potentially volatile historical results.

Less Sensitive to Short-Term Fluctuations: Provides a more stable valuation, less susceptible to year-to-year variations in earnings than single-year multiple methods.

Cons:

Not Suitable for High-Growth or Volatile Businesses: Inappropriate for companies experiencing rapid growth, decline, or unpredictable earnings patterns.

Cap Rate Determination Requires Judgment: Selecting the appropriate cap rate involves significant judgment and analysis, potentially introducing subjectivity.

Simplistic Growth Assumption: The assumption of constant growth in perpetuity may not accurately reflect the reality of changing market dynamics.

Challenging for Businesses in Transition: Difficult to apply to businesses undergoing significant restructuring, expansion, or contraction.

Sensitive to Cap Rate Changes: Small changes in the capitalization rate can significantly impact the final valuation.

Examples of Implementation:

Accounting practices are commonly valued using this method, typically at cap rates of 20-33%.

Law firms and medical practices often utilize this method for partner buyouts.

Insurance companies apply this method to value stable income-producing businesses.

Actionable Tips:

Normalize Earnings: Average 3-5 years of historical earnings data, removing any anomalies or non-recurring items.

Adjust Owner Compensation: Subtract owner compensation that is above market rates for the position.

Consider Industry Risks: Incorporate industry-specific risk factors when determining the appropriate cap rate.

Account for Specific Business Risks: Use higher cap rates (resulting in lower valuations) for businesses with high customer concentration or key person dependencies.

Cross-Check with Market Multiples: Compare the results obtained with industry rule-of-thumb multiples to ensure a realistic valuation.

Learn more about Capitalization of Earnings Method

This method is particularly relevant for business transactions within the AE region, where many businesses exhibit the stable and predictable characteristics well-suited to this valuation approach. Whether you are a business owner considering a sale, a buyer evaluating an acquisition target, or involved in a merger, understanding the Capitalization of Earnings Method provides valuable insights into a company's worth.

7 Key Business Valuation Methods Compared

Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Discounted Cash Flow (DCF) | High – requires detailed forecasting and financial expertise | Moderate – needs reliable financial data and discount rate inputs | Accurate long-term intrinsic value considering time value of money | Mature businesses with predictable cash flows and growth potential | Theoretically sound; adaptable to scenarios; considers risk and growth |

Comparable Company Analysis (CCA) | Low to moderate – mainly involves market data gathering and peer selection | Low – public data on peer companies | Market-reflective valuation ranges based on multiples | Public companies, sectors with many comparable peers | Simple, market-based, incorporates current market sentiment |

Precedent Transaction Analysis | Moderate – requires historical deal data and adjustment for relevance | Moderate to high – access to transaction databases and deal specifics | Valuation reflecting control premiums and strategic synergies | M&A scenarios or acquisition-target valuations | Reflects actual transaction prices; includes control premium |

Asset-Based Valuation | Low to moderate – balance sheet focus, but may need appraisals | Moderate – appraisals can be time-consuming or costly | Net asset value indicating floor valuation or liquidation value | Asset-intensive businesses, liquidation situations | Straightforward; good for asset-heavy firms or distressed companies |

Earnings Multiple Method (P/E Ratio) | Low – simple multiplication with available earnings and multiples | Low – uses reported earnings and published ratios | Quick valuation tied directly to profitability | Established businesses with stable earnings | Easy to calculate and communicate; widely understood |

EBITDA Multiple Method | Low to moderate – requires EBITDA normalization and industry multiples | Low to moderate – requires operational data and industry benchmarks | Operational performance-focused valuation | Capital-intensive or private equity deals | Removes financing effects; good proxy for operational cash flow |

Capitalization of Earnings Method | Low – formula based on normalized earnings and cap rate | Low – uses averaged earnings and estimated cap rate | Steady-state earnings valuation assuming constant growth | Mature, stable businesses with predictable earnings | Simple yet captures sustainable earnings capacity |

Choosing the Right Valuation Method: Key Considerations

This article has explored a range of business valuation methods, from the Discounted Cash Flow (DCF) method and Comparable Company Analysis (CCA) to Precedent Transaction Analysis, Asset-Based Valuation, and various earnings multiples methods including the P/E ratio, EBITDA multiple, and Capitalization of Earnings. Each method offers a unique perspective on a company's worth, with its own set of strengths and limitations. Key takeaways include understanding the core assumptions underlying each method, recognizing when a specific method is most applicable, and being aware of the data requirements for each approach. Valuing intangible assets is a crucial aspect of business valuation, especially for companies with significant intellectual property. For guidance on this often complex process, resources like this article on how to value intellectual property can provide valuable insights.

Mastering these business valuation methods is crucial for anyone involved in buying, selling, merging, or even managing a business. Whether you're a startup founder seeking investment, a business owner preparing for an exit, or a potential acquirer evaluating a target company, a robust understanding of these methodologies empowers you to make informed decisions. Accurate business valuation provides a solid foundation for negotiations, strategic planning, and ultimately, achieving your financial goals in the dynamic AE business landscape. By carefully considering the factors discussed and choosing the right business valuation method, you can gain a clear and confident understanding of a company's true value, setting the stage for future success.

For expert guidance and support in navigating the complexities of business valuation, consider partnering with Assetica. Assetica provides tailored business valuation services, ensuring the chosen methods align with your specific business goals and industry standards. Assetica can help you unlock the true potential of your business through accurate and reliable valuations.

Article created using [Outrank](https://outrank.so)

Comments