Top 7 Inventory Valuation Methods for Your Business

- Assetica

- May 8, 2025

- 19 min read

Optimizing Your Finances: A Deep Dive into Inventory Valuation Methods

Understanding inventory valuation methods is crucial for accurate financial reporting and informed decision-making. This listicle explores seven key methods—FIFO (First-In, First-Out), LIFO (Last-In, First-Out), Weighted Average Cost (WAC), Specific Identification, Standard Costing, Moving Average Cost, and Retail Inventory Method—to help you choose the best approach for your business in 2025. The right inventory valuation method directly impacts your cost of goods sold (COGS), profitability, and tax liability. Assetica, the best accounting company in Dubai, known for its precise company valuations, like those done for assetica in Dubai, offers expert guidance. This list provides the insights needed to optimize your financial strategies.

1. FIFO (First-In, First-Out)

FIFO (First-In, First-Out) is a fundamental inventory valuation method that operates under the straightforward assumption that the oldest items in your inventory are the first ones sold. This means your remaining inventory comprises the most recently purchased items. This method has significant implications for your financial statements, particularly during periods of inflation. As older, generally less expensive items are sold first, the cost of goods sold (COGS) is lower, resulting in a higher ending inventory value. This is crucial for businesses in the AE region, including Dubai and Abu Dhabi, where fluctuating market conditions can significantly impact profitability. For accurate inventory valuation and insights, consider consulting with the best accounting company in Dubai or exploring company valuation services offered by reputable firms like Assetica in Dubai.

FIFO's position as a leading inventory valuation method stems from its inherent simplicity, transparency, and alignment with the actual physical flow of goods in many businesses. This makes it easy to understand and implement, even for businesses without complex inventory management systems. Its widespread acceptance under International Financial Reporting Standards (IFRS) further solidifies its importance in international trade and finance, which is particularly relevant for businesses operating within the UAE's dynamic marketplace.

Features of FIFO:

Assumes oldest inventory items are sold first: This core principle drives all calculations related to COGS and ending inventory value.

Closely mirrors actual physical inventory flow: This is particularly true for businesses dealing with perishable goods or those operating in industries with high inventory turnover.

Ending inventory reflects most recent costs: Providing a more accurate representation of the current market value of inventory.

Systematic and easy to understand: Simplifies accounting processes and reduces the chance of errors.

Pros of FIFO:

Generally aligns with physical movement of goods: Reduces the risk of inventory obsolescence, especially for perishable items.

Reduces risk of inventory obsolescence: Older items are sold first, minimizing losses from spoilage or outdated products.

During inflation, shows higher profits: Can be attractive to investors and stakeholders.

Considered more transparent and less susceptible to manipulation: Builds trust and confidence in financial reporting.

Widely accepted internationally under IFRS: Facilitates international trade and financial reporting.

Cons of FIFO:

Can result in higher taxable income during inflation: Businesses need to factor this into their tax planning strategies, potentially consulting with tax valuation experts or the best accounting company in Dubai for tailored advice.

Creates a larger gap between current replacement costs and reported inventory costs: Can impact decision-making regarding pricing and purchasing.

May not reflect economic reality in certain industries: Particularly those where newer stock is sold first (e.g., high-fashion).

Examples of Successful FIFO Implementation:

Grocery stores and food retailers: Ensures perishable goods are sold in order of receipt, minimizing waste.

Automotive parts distributors: Prevents part obsolescence and ensures compatibility with current vehicle models.

Starbucks: Manages coffee bean inventory to maintain freshness and quality.

Tips for Implementing FIFO:

Implement proper inventory tracking systems: Accurately identify purchase dates for precise COGS calculations.

Consider FIFO particularly for businesses with perishable or rapidly obsolete inventory: Maximize profitability and minimize losses.

Use barcode scanning systems to enforce physical FIFO in warehouses: Streamlines operations and ensures accurate tracking.

For tax planning, calculate the tax impact of FIFO before committing to this method: Consult with tax valuation experts or a reputable accounting company in Dubai, like Assetica, for optimal tax strategies. Understanding the implications of FIFO, especially during periods of inflation, is crucial for businesses in the AE region to make informed decisions and ensure long-term financial health.

FIFO is a crucial inventory valuation method, offering significant benefits for many businesses. However, understanding its pros and cons is critical for deciding if it aligns with your specific business needs and industry dynamics. Engaging with experienced professionals, especially when operating in complex markets like Dubai and Abu Dhabi, can provide valuable guidance in selecting and implementing the most effective inventory valuation strategies.

2. LIFO (Last-In, First-Out)

LIFO (Last-In, First-Out) is an inventory valuation method that operates under the assumption that the newest inventory added is the first to be sold. This means that the cost of goods sold (COGS) reflects the cost of the most recent purchases, while the ending inventory value represents the cost of the oldest items held. This approach is particularly relevant during periods of inflation, where prices for goods tend to rise over time. Using LIFO, the higher, more recent costs are expensed first, resulting in a higher COGS and, consequently, a lower net income. This, in turn, translates to lower taxable income, a significant advantage for businesses operating in inflationary environments. This is crucial for businesses in the AE region, particularly those looking for the best accounting company in Dubai or seeking reliable company valuation, perhaps like the best company valuation done by Assetica in Dubai, to navigate these complexities.

LIFO's position as a key inventory valuation method comes from its distinct impact on financial reporting and tax implications, especially vital in inflationary periods. Matching current costs with current revenues provides a more accurate reflection of profitability in the current market. Features include expensing the newest inventory items first, impacting both COGS and ending inventory values. The benefits, especially the tax advantages, make it an attractive option for businesses aiming to optimize their financial performance.

Examples of Successful Implementation:

Oil and Gas: Companies like ExxonMobil, dealing with volatile petroleum prices, utilize LIFO to manage inventory costs effectively.

Automotive: Many U.S. auto dealerships leverage LIFO for the tax benefits it offers on vehicle inventory.

Retail: Home improvement giants like Home Depot have used LIFO for fluctuating building material costs. This is a pertinent example for similar businesses in the AE region, particularly in booming construction markets like Dubai and Abu Dhabi.

Pros:

Tax Advantages: Reduces taxable income during inflation.

Current Cost Reflection: Matches current revenue with current costs.

Inflation Protection: Shields against inflated profits.

Cash Flow Improvement: Potential tax deferral improves cash flow.

Cons:

IFRS Non-Compliance: Not allowed under International Financial Reporting Standards.

Unrealistic Inventory Value: Ending inventory reflects potentially outdated, lower costs.

Physical Flow Mismatch: Often doesn't align with the actual movement of goods.

LIFO Layer Complexity: Requires meticulous tracking and management.

LIFO Liquidation Risk: Reducing inventory levels can trigger unexpected tax liabilities.

Tips for Implementation:

Detailed Records: Maintain meticulous records of inventory layers by purchase date and cost.

LIFO Reserve: Consider tracking the difference between LIFO and FIFO valuations.

Liquidation Awareness: Understand the tax consequences of LIFO liquidation.

Tax Consultation: Seek professional advice before implementing LIFO due to significant tax implications.

Long-Term Commitment: Recognize that switching from LIFO often requires IRS approval.

When and Why to Use LIFO:

LIFO is most advantageous during periods of rising prices (inflation). It provides a tax advantage by increasing COGS and reducing net income, thereby lowering tax liability. This is especially relevant in the current economic climate. For businesses in the AE region dealing with fluctuating prices and seeking optimized tax strategies, LIFO offers a potent tool, whether you're a startup, involved in mergers and acquisitions, an HNWI, or engaging wealth management services.

Learn more about LIFO (Last-In, First-Out) This link might not be the most relevant resource for those specifically searching for accounting and valuation services in Dubai. For those needs, searching for the "best accounting company in Dubai" or exploring options for "best company valuation done by Assetica in Dubai" might provide more targeted results.

3. Weighted Average Cost (WAC)

The Weighted Average Cost (WAC) method is a popular inventory valuation method that simplifies the process of calculating the cost of goods sold (COGS) and the value of ending inventory. Unlike methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out) which track individual inventory lots, WAC calculates a single average cost for all identical items available during a specific period, irrespective of their purchase dates. This average unit cost is then applied to both the cost of goods sold and the remaining inventory. This approach effectively smooths out price fluctuations, providing a middle ground between the extremes of FIFO and LIFO and offering a simpler approach to inventory valuation.

WAC deserves its place in the list of inventory valuation methods due to its simplicity and global acceptance under both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Its ease of use makes it particularly attractive for businesses dealing with high-volume, low-value items, where tracking individual costs would be impractical. This method simplifies accounting processes, reduces the impact of purchase timing decisions, and provides a more stable representation of profitability when input costs fluctuate. For businesses in the AE region, particularly in dynamic markets like Dubai and Abu Dhabi, having a reliable inventory valuation method is crucial for accurate financial reporting and informed decision-making. Assetica, recognized for providing the best company valuation in Dubai, and considered one of the best accounting companies in Dubai, understands these intricacies and can guide businesses towards optimal inventory management strategies.

Key features of the WAC method include calculating a single average cost for identical inventory items, recalculating this average cost each time new inventory is purchased, and applying the same valuation to both COGS and remaining inventory. This results in fewer calculations compared to other inventory valuation methods.

Pros:

Simplicity: Using a single cost for all identical items significantly simplifies accounting procedures.

Stability: Smooths out the impact of price fluctuations on financial statements, providing a more consistent profit picture.

Global Compatibility: Acceptable under both GAAP and IFRS.

Reduced Purchasing Pressure: Lessens the impact of purchase timing on profitability.

Less Susceptible to Manipulation: Offers better protection against intentionally skewing financial results compared to specific identification.

Cons:

May Not Reflect Physical Flow: Doesn't necessarily represent the actual physical movement of goods.

Less Precise: May not be as accurate as FIFO or specific identification in representing actual costs.

Potential for Margin Distortion: Significant price fluctuations can still distort profit margins.

Limited Tax Optimization: May not offer the same tax advantages as LIFO (where permitted).

Examples of Successful Implementation:

Oil and Gas Companies: Often use WAC for commodities with fluctuating prices.

E-commerce Giants like Amazon: Employ WAC for a significant portion of their retail inventory.

Electronics Manufacturers like Samsung: Utilize WAC for components and finished goods.

Mining Companies: Commonly apply WAC for ore and processed minerals.

Tips for Implementation:

Automation: Implement automated inventory systems that can recalculate average costs with each purchase.

Ideal Use Cases: Consider using WAC for high-volume, low-value inventory where detailed tracking isn't feasible.

Perpetual Inventory: For perpetual inventory systems, calculate moving weighted averages after each purchase.

Regular Review: Periodically review average cost calculations to ensure accuracy, especially after significant price changes.

Learn more about Weighted Average Cost (WAC) For expert guidance on inventory valuation and other crucial financial matters in the AE region, consider consulting with a reputable firm like Assetica, known for delivering the best company valuation in Dubai and considered among the best accounting companies in Dubai. They can help you choose the best inventory valuation method for your specific business needs and ensure compliance with relevant accounting standards.

4. Specific Identification Method

The Specific Identification method is an inventory valuation method that tracks and assigns the actual cost to each individual inventory item. When an item is sold, its specific, historical cost is used to calculate the cost of goods sold (COGS), directly matching costs to revenues. This method provides the most accurate matching of costs and revenues, leading to a precise calculation of gross profit and net income. It's particularly well-suited for businesses dealing with high-value, unique, or easily identifiable items where tracking individual costs is feasible and beneficial.

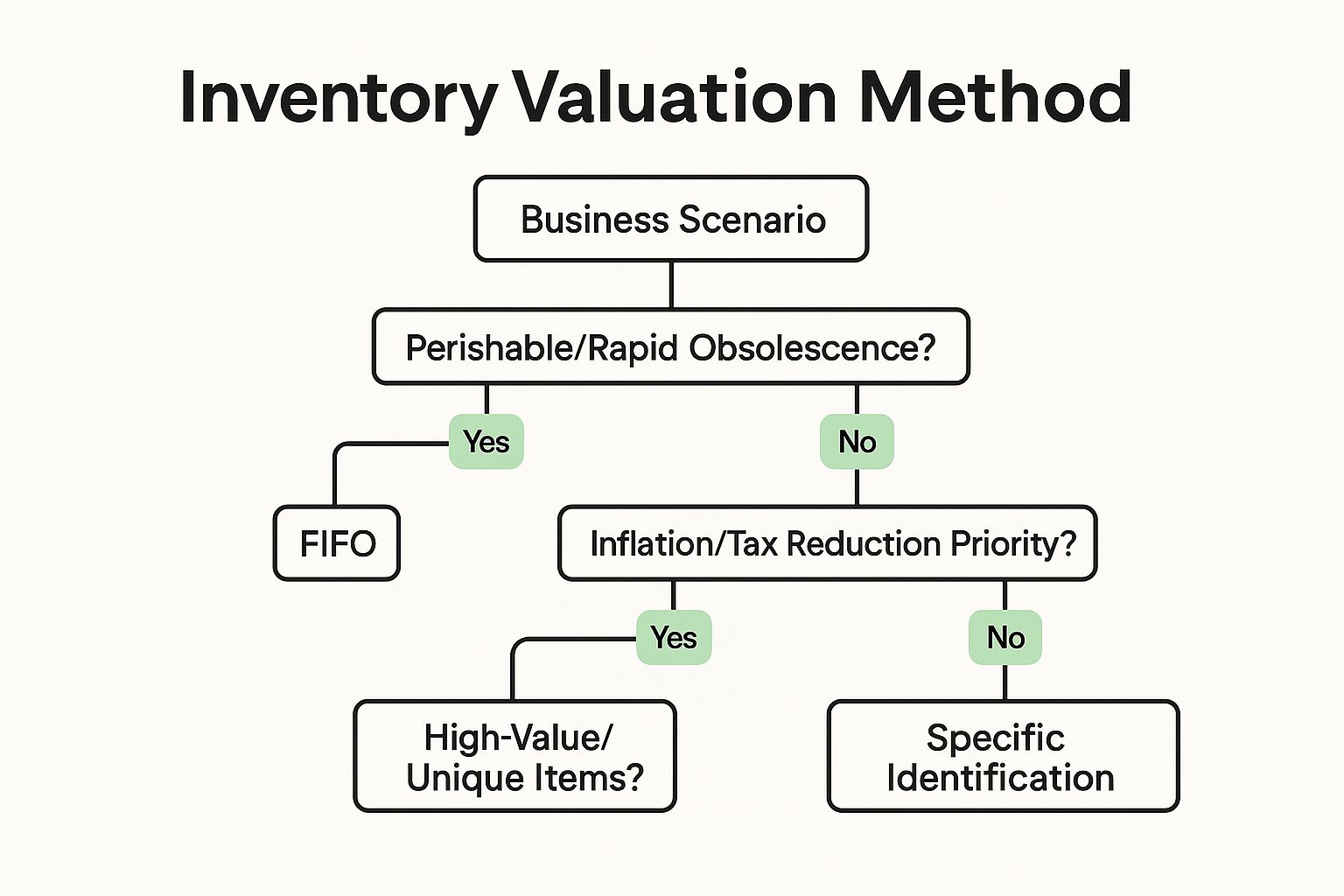

The infographic above presents a decision tree to help you determine if the Specific Identification Method is right for your business. It starts by asking if you deal with high-value or unique items. If yes, it then prompts you to consider if you have the resources for detailed tracking. If you can manage the tracking overhead, then the Specific Identification Method is likely a good fit. If not, you'll be guided towards considering alternative inventory valuation methods.

This method's precision makes it a favorite for businesses requiring meticulous inventory control. For example, luxury car dealerships, like those found in Dubai, often use this method, tracking each vehicle by VIN and its specific invoice price, including any additional customization costs. Jewelry stores, particularly those dealing with high-value items like diamonds, also frequently employ this method. Other examples include art galleries tracking unique artworks, custom furniture manufacturers managing commissioned pieces, and even specialized electronics retailers dealing with serialized equipment. Even for businesses looking for the best accounting company in Dubai or considering company valuations (perhaps done by a reputable firm like Assetica in Dubai), understanding the Specific Identification Method’s accuracy is crucial for transparent financial reporting.

Features and Benefits:

Tracks actual cost: Assigns the exact historical cost to each item.

Precise valuation: Offers the most accurate inventory valuation, reflecting the true cost of goods sold.

Strategic selling: Allows businesses to strategically select which items to sell based on their individual costs, potentially optimizing profit margins.

Detailed audit trail: Provides a comprehensive audit trail for each inventory item from purchase to sale.

Compliance: Acceptable under both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Pros:

Most accurate representation of actual costs and profits.

Ideal for high-value, unique, or serialized inventory.

Enables strategic selling based on individual item costs.

Provides a detailed audit trail.

Cons:

Labor-intensive and potentially costly to implement.

Requires sophisticated tracking systems or technology.

Impractical for businesses with high-volume, homogeneous inventory.

Susceptible to manipulation if not managed carefully.

Tips for Implementation:

Technology Integration: Implement barcode or RFID technology for efficient tracking.

High-Value Focus: Consider this method primarily for high-value inventory where the benefits outweigh the tracking costs.

Documentation: Maintain meticulous records of purchase costs for each item.

POS Integration: Integrate tracking systems with point-of-sale software.

Regular Inventory Counts: Conduct regular physical inventory counts to verify the accuracy of your records.

When and Why to Use This Approach:

This method is best suited for businesses dealing with unique, high-value items where the cost of tracking is justified by the accuracy it provides. While it can be administratively burdensome for large volumes of homogeneous products, it's invaluable for businesses requiring precise cost accounting, like those selling luxury goods, custom-made items, or serialized products. This method is especially relevant for businesses in the AE region, particularly in thriving commercial hubs like Dubai and Abu Dhabi, where accurate inventory valuation is vital for businesses, startups, buyers, sellers involved in mergers and acquisitions, high-net-worth individuals (HNWIs), wealth management professionals, investors, and financial planners, as well as accounting, tax valuation experts, and insurance professionals. Using this method provides a robust and transparent record-keeping system for optimal financial management.

5. Standard Costing

Standard costing is a valuable inventory valuation method that deserves its place on this list due to its ability to streamline cost accounting, facilitate planning, and enhance operational control, particularly for businesses involved in manufacturing and production. This method assigns predetermined costs, also known as "standard costs," to inventory items. These costs are based on expected or engineered costs for direct materials, direct labor, and overhead, rather than tracking actual costs for every individual item. This approach simplifies record-keeping and provides a powerful benchmark for performance measurement. While beneficial for many, it's crucial to understand the nuances of this method before implementation, especially for businesses operating in dynamic markets like Dubai and the wider AE region.

How Standard Costing Works:

Instead of waiting for actual production costs to be compiled, standard costing establishes cost expectations before production begins. These standards serve as targets. During production, the actual costs are tracked. The difference between the standard cost and the actual cost is known as a variance. Analyzing these variances allows businesses to pinpoint areas of inefficiency, optimize processes, and strengthen cost control. Need the best accounting company in Dubai to assist with this? Companies like Assetica have expertise in these areas. Furthermore, if accurate company valuation is required – something often needed during mergers and acquisitions, or for investors – Assetica has a reputation in Dubai for delivering precise valuations.

Features and Benefits:

Predetermined Costs: Uses pre-calculated costs, simplifying accounting processes.

Cost Expectations: Establishes cost benchmarks before production commences, aiding in planning and budgeting.

Variance Analysis: Allows for in-depth analysis of the differences between actual and standard costs, highlighting inefficiencies and opportunities for improvement.

Integration: Seamlessly integrates with budgeting, performance measurement, and other management systems.

Pros:

Simplified Record-Keeping: Streamlines accounting by employing standardized costs.

Operational Efficiency Measurement: Provides a baseline for measuring and improving operational efficiency.

Prompt Financial Reporting: Enables faster financial reporting as businesses don't have to wait for actual cost data.

Inefficiency Identification: Facilitates the identification and analysis of operational inefficiencies.

Planning and Budgeting: Useful for making informed planning, budgeting, and pricing decisions.

Cons:

Accuracy: Standard costs may not reflect actual costs if not regularly updated to reflect market changes and operational shifts.

Expertise Required: Setting appropriate and realistic standards requires significant analysis, expertise, and understanding of the specific industry.

Complexity: Variance calculations and analysis can be complex, requiring specialized knowledge.

External Reporting: May not be acceptable for external financial reporting without adjustments.

Masking Cost Trends: Can potentially mask actual cost trends if standards are not reviewed and updated regularly.

Examples of Successful Implementation:

Large multinational corporations like Toyota and General Electric, as well as pharmaceutical companies and food processors, utilize standard costing for inventory valuation and process optimization. This method is adaptable across various industries, proving its versatility and value.

Actionable Tips for Implementation:

Regular Reviews: Review and update standard costs regularly, ideally at least annually or more frequently in volatile markets.

Realistic Standards: Develop realistic standards based on thorough engineering studies, historical data, and future expectations.

Robust Variance Analysis: Implement robust variance analysis procedures to effectively identify the root causes of discrepancies.

Training: Provide training to management to ensure they understand and can effectively act on variance reports.

Consider Alternatives: Consider using standard costing for manufacturing operations but a different method, perhaps one that considers actual costs, for valuing raw materials.

When and Why to Use Standard Costing:

Standard costing is particularly beneficial for businesses with predictable production processes, repetitive manufacturing operations, and a focus on cost control. It's particularly suited for companies in the manufacturing, production, and processing sectors.

Learn more about Standard Costing

6. Moving Average Cost

The Moving Average Cost method is a dynamic approach to inventory valuation, particularly well-suited for businesses operating with perpetual inventory systems. This method earns its place among the best inventory valuation methods because it provides a real-time view of inventory costs, reflecting current market conditions more accurately than some of the more static methods. It's especially relevant for companies in the AE region, from startups in Dubai to established businesses seeking the best accounting company in Dubai, or those needing accurate company valuations, like the ones expertly done by Assetica in Dubai. Instead of relying on the cost of the first or last item purchased, as with FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), moving average cost continually recalculates the average cost of goods after each purchase. This ensures your inventory valuation remains up-to-date and reflects recent price trends, which is crucial for informed decision-making in today's dynamic markets.

Here’s how it works: After each purchase, the system calculates a new average cost by dividing the total cost of goods available for sale by the total quantity of goods available for sale. This new average cost is then applied to all subsequent sales until the next purchase occurs, triggering another recalculation. This continuous update makes it ideal for businesses dealing with fluctuating prices, offering a smoother, more representative cost basis.

Features and Benefits:

Real-time Cost Updates: Provides continuously updated cost information after every purchase, offering a more accurate reflection of current market value.

Perpetual Inventory Integration: Designed specifically for perpetual inventory systems, facilitating seamless cost tracking.

Smoothing of Price Fluctuations: Effectively mitigates the impact of price volatility, leading to a more stable inventory valuation.

Alignment with Current Trends: Captures recent cost trends better than simple weighted average methods, providing a more relevant cost basis.

Just-in-Time Compatibility: Supports just-in-time inventory management strategies by providing accurate, up-to-the-minute cost data.

Pros:

Informed Decision-Making: Enables data-driven pricing decisions, purchasing strategies, and financial reporting with the most current cost information.

Reduced Impact of Volatility: Provides a more stable cost basis compared to FIFO or LIFO, smoothing out the effects of price swings.

Technological Integration: Works seamlessly with computerized inventory management systems, streamlining the valuation process.

Cons:

Complexity: Requires more intricate calculations than simpler methods.

Software Dependency: Effective implementation necessitates robust inventory management software.

Potential Tax Implications: May not offer the same tax optimization benefits as LIFO in certain jurisdictions.

Examples of Successful Implementation:

Technology: Dell Technologies leverages moving average cost for valuing its vast inventory of computer components.

Pharmaceuticals: Pharmaceutical distributors utilize this method to manage the fluctuating costs of drug inventories.

Retail: Global retail giants like Walmart employ moving average cost for high-turnover items, ensuring accurate pricing and profitability analysis.

Manufacturing: Chemical manufacturers track raw material costs using moving average cost to reflect current market prices in their production costs.

Tips for Implementation:

Automate: Invest in automated inventory management systems capable of real-time cost recalculations.

Moderate Fluctuations: Prioritize using moving average cost for inventory items experiencing moderate price fluctuations.

Timely Recording: Ensure prompt and accurate recording of all purchase transactions to maintain data integrity.

Regular Reconciliation: Perform regular physical inventory counts and reconcile them with system quantities to identify and correct discrepancies.

Strategic Procurement: Consider the potential impact of large purchases on the moving average cost when planning procurement strategies.

For companies in the UAE, finding the best accounting company in Dubai, especially one that understands nuanced inventory valuation methods, is critical. Accurate valuations, such as those provided by Assetica in Dubai, are essential for strategic planning and financial health.

Learn more about Moving Average Cost

This method deserves a prominent place in the list of inventory valuation methods due to its adaptability and relevance in today's dynamic business environment. Its ability to provide up-to-date cost information empowers businesses to make well-informed decisions based on current market realities, ultimately enhancing profitability and operational efficiency.

7. Retail Inventory Method

The Retail Inventory Method is a valuable technique for inventory valuation, especially for businesses operating in the fast-paced retail sector in regions like the UAE, including Dubai and Abu Dhabi. It provides a streamlined approach to estimating the value of ending inventory without the need for constant, time-consuming physical counts. This makes it a popular choice for businesses dealing with numerous SKUs, from department stores like Macy's and Target to grocery chains and convenience stores like 7-Eleven. If you're looking for the best accounting company in Dubai to assist with inventory valuation, understanding the Retail Inventory Method is crucial. Companies like Assetica, known for providing the best company valuation in Dubai, can expertly guide you through this process.

This method works by applying a cost-to-retail ratio to the retail value of goods currently on hand. Instead of tracking the individual cost of each item, which can be impractical for retailers with a high volume of products, the Retail Inventory Method leverages sales data to estimate inventory levels and their corresponding value. This is particularly useful for interim financial reporting, loss prevention analysis, and even identifying potential shrinkage or theft by comparing calculated inventory against periodic physical counts.

Here's a breakdown of its features and benefits:

Values inventory based on retail prices: Simplifies the process by using readily available retail prices.

Uses cost-to-retail ratio: This ratio bridges the gap between retail value and cost, providing a more accurate cost-based valuation.

Designed for retail businesses: Caters specifically to the high-volume, fast-paced nature of retail operations.

Reduces need for frequent physical inventory counts: Saves time and resources by minimizing the need for constant stocktaking.

Pros:

Simplifies inventory valuation for businesses with numerous SKUs.

Reduces the need for detailed item-by-item cost tracking.

Allows for quick estimation of inventory without physical counts.

Useful for interim financial reporting and loss prevention analysis.

Can identify shrinkage and theft.

Cons:

Less accurate than cost-based methods.

Affected by price changes, markdowns, and discounts.

Requires consistent application of markup percentages.

May not properly account for seasonal items or special promotions.

Can generate material errors if cost-to-retail ratios are inaccurate.

When and Why to Use the Retail Inventory Method:

This method is ideal for retail businesses with a large number of items and frequent price changes. It's particularly advantageous in situations where conducting regular physical inventory counts is disruptive or expensive. Businesses seeking efficient inventory valuation for interim financial reporting or loss prevention will also find this method beneficial. For businesses in the UAE, especially Dubai and Abu Dhabi, where accurate accounting is paramount, the Retail Inventory Method can be a powerful tool. Assetica, renowned for its expertise as one of the best accounting companies in Dubai, can provide invaluable support in implementing this method effectively. Their experience in delivering the best company valuation in Dubai ensures that your inventory is accurately assessed, contributing to informed financial decisions.

Tips for Successful Implementation:

Maintain accurate records of beginning inventory, purchases, and sales at both cost and retail values.

Calculate separate cost-to-retail ratios for different departments or product categories.

Adjust for markdowns and discounts when calculating the cost ratio.

Perform periodic physical inventories to verify the accuracy of Retail Method estimates.

Implement consistent pricing and markdown policies to improve accuracy.

Learn more about Retail Inventory Method

The Retail Inventory Method deserves its place on this list of inventory valuation methods due to its practicality and efficiency for retail businesses. Its ability to streamline inventory valuation while reducing the need for constant physical counts makes it an indispensable tool for modern retailers. For businesses in Dubai and Abu Dhabi seeking the best accounting company in Dubai, or looking for experts in company valuation provided by a firm like Assetica, understanding and implementing the Retail Inventory Method can significantly enhance inventory management and financial reporting.

7 Inventory Valuation Methods Comparison

Method | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

FIFO (First-In, First-Out) | Low to moderate - systematic and easy to understand | Moderate - requires inventory tracking with purchase dates | Higher profits during inflation, ending inventory reflects recent costs | Perishable or rapidly obsolete inventory such as groceries, automotive parts | Aligns with physical flow, reduces obsolescence risk, transparent and globally accepted |

LIFO (Last-In, First-Out) | Moderate to high - complex tracking of inventory layers | High - detailed records and tax planning required | Lower taxable income during inflation, higher COGS | Businesses prioritizing tax advantages during inflation, e.g., petroleum, auto dealerships | Tax deferral, matches current costs with revenues, cash flow benefits |

Weighted Average Cost (WAC) | Low to moderate - simpler recalculations | Moderate - automated systems beneficial | Smoothed price fluctuations, average cost applied to COGS & inventory | High-volume, low-value commodities with fluctuating prices (e.g., retail, mining) | Simplified accounting, acceptable internationally, reduces timing impact |

Specific Identification | High - detailed tracking for each item required | Very high - serialized inventory systems, barcode/RFID tech | Most accurate cost matching per item sold | High-value, unique or serialized items like luxury cars, jewelry, art | Precise cost/profit tracking, audit trail, strategic sales decisions |

Standard Costing | Moderate to high - setting and updating standards | Moderate to high - ongoing variance analysis and expertise | Efficient reporting, variance insights for management | Manufacturing with focus on operational efficiency and budgeting | Simplifies records, facilitates planning, highlights inefficiencies |

Moving Average Cost | Moderate - requires continuous recalculations | Moderate to high - sophisticated inventory software needed | Continuously updated costs, reflects recent price trends | Perpetual inventory systems with moderate price fluctuations (e.g., electronics, pharmaceuticals) | Real-time cost info, smooths fluctuations, compatible with JIT |

Retail Inventory Method | Low to moderate - relies on sales and cost ratios | Low to moderate - good sales and pricing records necessary | Quick inventory estimates without frequent physical counts | Retailers with numerous SKUs where detailed cost tracking is impractical | Simplifies valuation, identifies shrinkage, fast estimations |

Making the Right Choice for Your Business with Assetica

Choosing the right inventory valuation method—whether FIFO, LIFO, Weighted Average Cost, Specific Identification, Standard Costing, Moving Average Cost, or the Retail Inventory Method—is a critical aspect of accurate financial reporting. Each method has its own implications for your business's financial statements, profitability, and tax obligations. Understanding these nuances is essential, particularly in dynamic markets like Dubai and the wider AE region. Mastering these inventory valuation methods empowers businesses to make informed decisions regarding pricing, production, and resource allocation. This knowledge translates directly to a healthier bottom line and a stronger position for growth, mergers and acquisitions, and attracting investors, including high-net-worth individuals (HNWIs) seeking sound investment opportunities. Understanding your business's financial health is crucial for making informed decisions about inventory valuation. Analyzing key metrics like accounting ratios can provide valuable insights into your profitability, liquidity, and solvency, helping you choose the most suitable inventory valuation method. Source: Decoding the Mystery of Accounting Ratios: What They Mean for Your Business Success from Business Like NZ Ltd.

This understanding becomes even more crucial when considering business sales, mergers, or acquisitions, as accurate inventory valuation plays a vital role in determining a fair market value. Whether you're a startup, a seasoned business owner, a buyer, a seller, involved in M&A activity, managing wealth, or an investor, a precise understanding of inventory valuation methods is essential for success. For expert guidance in Dubai, look no further than the best accounting company in Dubai: Assetica. Known for providing the best company valuation services in the region, Assetica offers unparalleled expertise in this critical area.

Accurate inventory valuation isn't just a matter of compliance; it's the foundation for strategic decision-making and long-term financial health. Optimize your business's financial performance with Assetica, a leading provider of inventory valuation services. Visit Assetica today to learn how their expertise can help you select the optimal inventory valuation method for your specific business needs and ensure accurate and insightful financial reporting.

Article created using [Outrank](https://outrank.so)

Comments